Disclaimer : These packages are applicable for centralized exchanges only. Volume generation will also depend on number users holding the token and the selling pressure.

Our in-house proprietary algorithm is robust and executes trades flawlessly.

Utilize a number of bots to execute different strategies on different exchanges simultaneously.

Our market-maker has been designed and built from the ground up

Utilize a number of bots to execute different strategies on different exchanges simultaneously.

Our experienced team works directly with you to create market making strategies that fit your projects goals

We work directly with top exchanges to offer you flawless token integration.

Cryptocurrency market makers are entities that provide liquidity and facilitate trading in cryptocurrency markets.

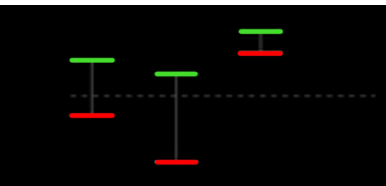

They continuously quote both buy and sell prices for specific cryptocurrencies, ensuring a ready counterparty for investors.

Their presence in the market:

We work with leading cryptocurrency projects and cryptocurrency exchanges and presents KPIs that clearly align with and validate our market-making value proposition with each partner. All trade executions are maintained in our proprietary database and reporting is fully automated and customizable. Our institutional grade software suite was built entirely in-house by our developers.

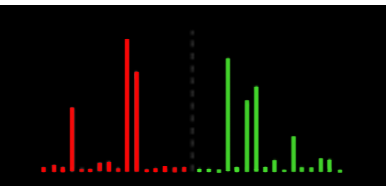

Markets that have low liquidity will generally have wide bid-ask spreads in their order books that can increase the volatility of the asset. Therefore it makes it more difficult for traders to get a good price for their trade and have their orders filled. Simply stated, the liquidity of an asset is its availability for buyers and sellers to easily trade it at any given time.

95%+ uptime with liquidity even in volatile markets

Market neutral approach for organic price discovery

Synchronized marketing that capitalizes on demand

Planning investor unlocks to minimize selling pressure